Developers are building nearly 3M SF of new office space in Midtown Atlanta, more than half of all new office construction in the region. And if more developers have their way, Atlanta’s hottest office submarket could see more than 8M SF more rise there in the near future.

While the submarket hasn’t been immune to the office slowdown this year — Class-A offices in Midtown were 23.8% vacant as of June, among the highest rates in Metro Atlanta — developers say Midtown will remain the preferred destination for companies chasing talent and the amenities of larger cities.

View of the Midtown Atlanta skyline from Piedmont Park

“If you feel optimistic about job growth in Atlanta, then you’re obviously going to feel optimistic about what’s happening in Midtown,” said Selig Development Chief Operating and Development Officer Steve Baile, whose firm is developing the 1105 West Peachtree tower, which Google has leased.

“It’s not just an office market, it’s not just a residential market,” Baile said. “It feeds all food groups.”

While absorption was weak during the first six months of 2021 — Midtown absorbed just 56,600 SF of office space during that time, according to JLL, despite over 1M SF of deliveries — Colliers projects it will surge back in the third quarter, turning positive by 1.1M SF, thanks in part to Microsoft occupying its 500K SF offices at Atlantic Yards, Colliers Director of Research Scott Amoson said.

Experts say leasing momentum is gaining steam again in Midtown, which could justify developer optimism on the submarket.

“I do not believe that demand is waning in Midtown,” Transwestern Vice President of Research Keith Pierce wrote in an email. “The second half of 2021 will likely show some strong absorption numbers as companies like Microsoft and Google begin to take occupancy of their new hubs.”

The submarket has already lured a number of banner tenants, including names like Microsoft, Anthem Blue Cross Blue Shield and Google, as executives chased talent coming out of Georgia Tech, Georgia State University and the various Historically Black Colleges and Universities in the city.

The leasing momentum, along a large pipeline of office prospects, has allowed area landlords to command some of the highest rents in the metro area. Midtown rents today average more than $40 per SF, up from $34.50 just three years ago, according to data compiled by Transwestern.

“I’m still very bullish. If I had this level of activity and Covid had never been around, I’d be pleased,” said Chris Scott, a partner with Greenstone Properties, which is constructing 14th & Spring, a 320K SF office building that is set to be delivered by July. Greenstone has yet to sign any leases for the building.

“In Midtown, being a year out … the level of interest and presentations I felt were on par with what I kind of [was] expecting,” Scott said.

Courtesy of Greenstone Properties

Rendering of the 14th & Spring mixed-use project in Midtown

Colliers Senior Vice President Jessica Doyle said Midtown will continue to be a primary destination choice for companies coming from the West Coast and Northeast, especially technology firms.

“The number of large deals out in the market is very encouraging,” Doyle said. “We still are seeing the most large deals that I’ve ever seen in my career.”

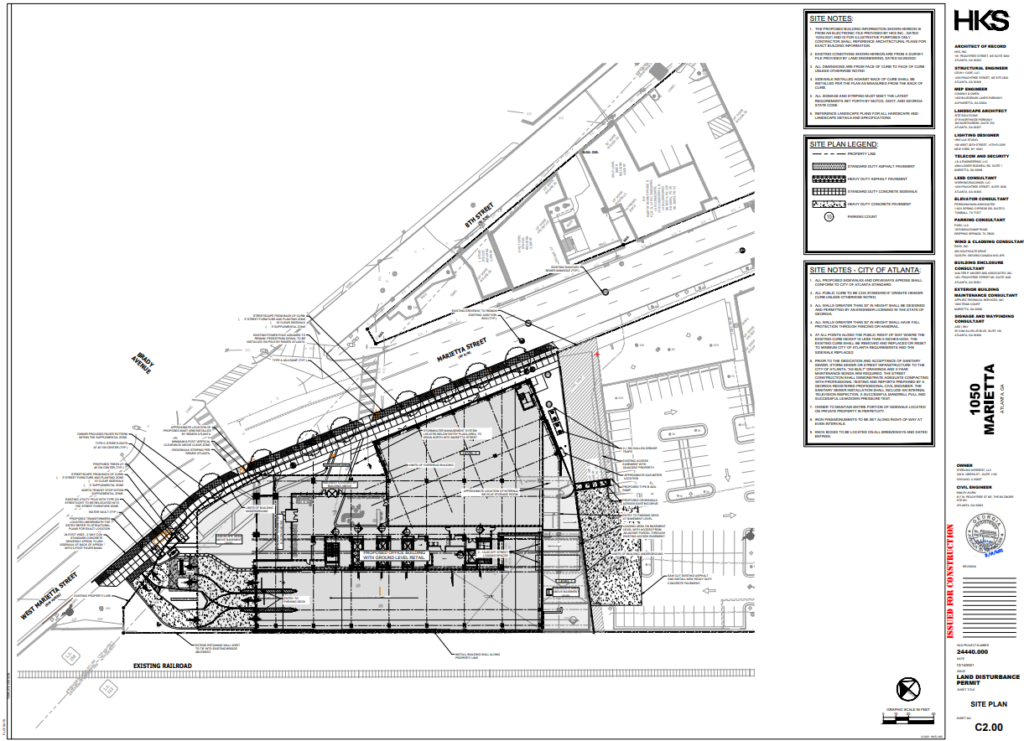

Greenstone is far from the only developer vying for those deals: According to CoStar data compiled by Transwestern, developers are planning more than 8.5M SF of additional office projects, including New City Properties and Cousins Properties‘ 200K SF joint venture development next door to 725 Ponce, Cousins’ planned 390K SF tower at 901 West Peachtree St. and Portman Holdings‘ planned 1020 Spring St. mixed-use complex.

Cousins Properties Executive Vice President Richard Hickson noted the demand for space in Midtown and Buckhead during the company’s July second-quarter earnings call.

“Atlanta, our largest market, continues to see an uptick in demand, particularly from the technology sector, and Midtown and Buckhead are leading the recovery so far this year,” Hickson said. “Our current leasing pipelines in both Buckhead and Midtown are equally encouraging. As we look ahead, we believe we will continue to see a noticeable flight to quality.”

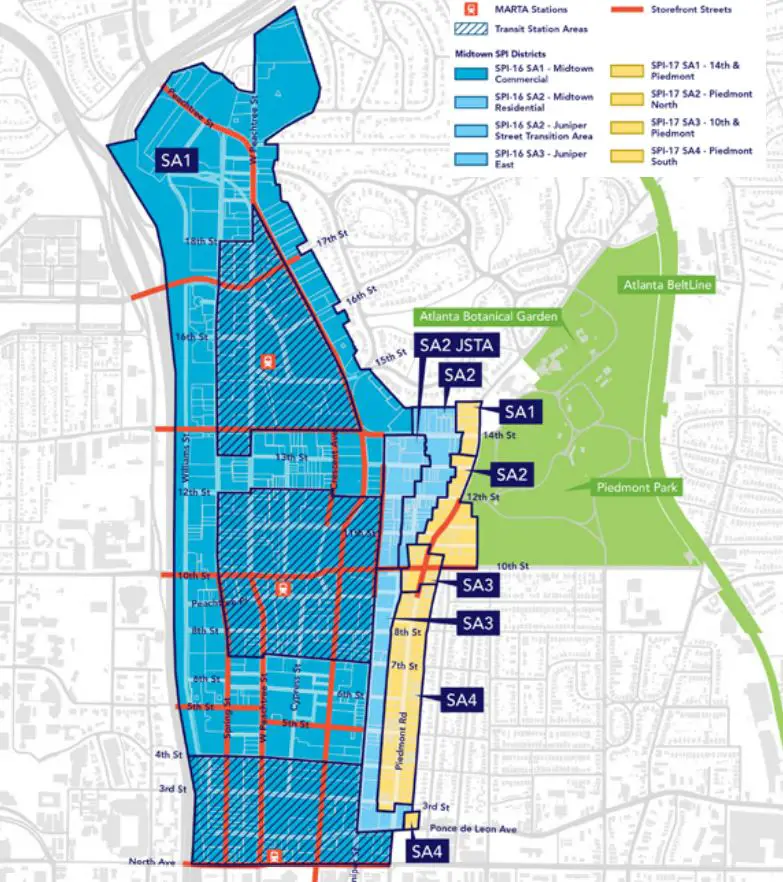

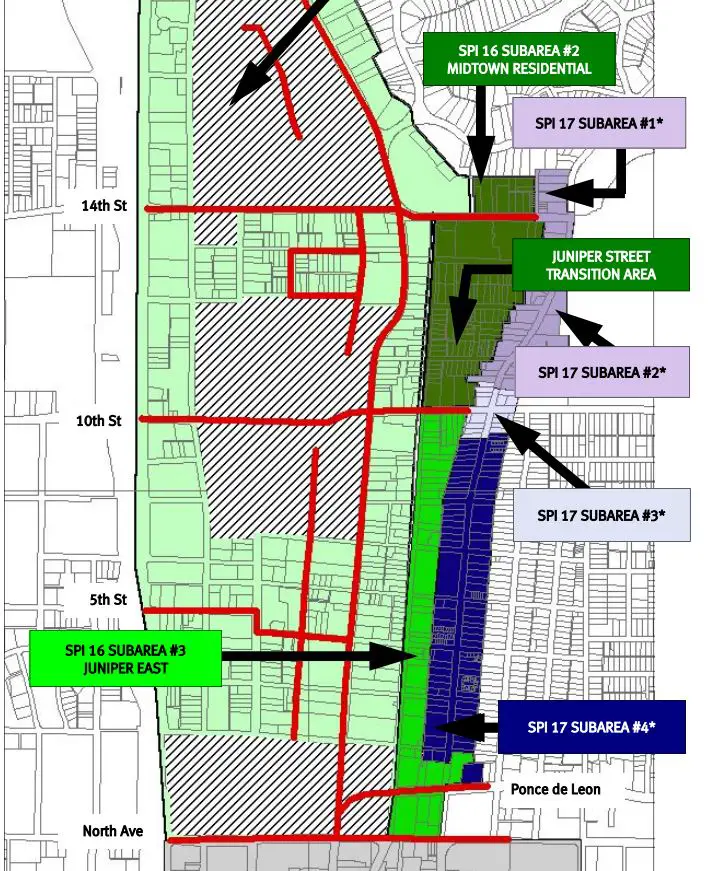

Part of the attraction to Midtown from outside companies is the submarket’s design: Midtown is laid out in a grid pattern, like other major cities, and has plenty of access to Atlanta’s mass transit system, Regent Partners Director Keith Mack said. Other submarkets in the metro area — especially out in the suburbs — were designed for automobile dependency.

“I still think Midtown is kind of the most urban submarket that we have,” Mack said. “Midtown proper, if you can find land, I think it’s still ripe for development.”

Of the nearly 3M SF underway, 65% has been already leased up by tenants, according to Colliers. Many of the planned projects may wait to break ground until they sign a significant anchor tenant.

“Companies like [Microsoft and Google] don’t come along every day, and developers are likely to proceed cautiously with new projects while seeking to land a whale,” Pierce said.

Baile said Selig is taking that approach for the second phase of its West Peachtree project, where it could add an additional 500K SF of office along with 400 apartment units. It pre-leased the first phase, securing both Google and the law firm Smith Gambrell & Russell, before putting shovels in the dirt.

“We need to have some momentum on another office lease,” Baile said. “That will be the catalyst for us on breaking ground.”

September 22, 2021

Jarred Schenke, Bisnow Atlanta

Link to Article